are inherited annuities tax free

B Full payout over the next five years. Ad Fixed Payments Eliminate The Impact Of Market Volatility.

Annuity Beneficiaries Inheriting An Annuity After Death

Spouses have more control over changing the terms of inherited annuities.

. Annuity Owner Dies before the age. Taxes owed on an inherited annuity will depend on the payout structure and the status of the beneficiary. Different tax consequences exist for spouse versus non-spouse beneficiaries.

However there are no RMD issues and you wont have that 10 early. As someone other than the surviving spouse you will basically have three potential options. That means you dont pay taxes on the funds while they grow.

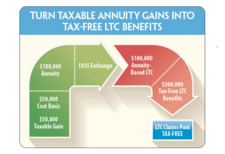

You have an annuity purchased for 40000 with after-tax money. Surviving spouses can change the original contract. A 1035 exchange allows nonqualified annuities to be exchanged for another nonqualified annuity tax-free.

Annual payments of 4000 10 of your original investment is non-taxable. If you do not like the features of an annuity you can trade it for. Ad 11 Tips You Absolutely Must Know About Annuities Before Buying.

Tax Consequences of Inherited Annuities. Learn More About Annuities. Tax-deferred means you will pay ordinary income tax on the earnings portions of your distributions.

Annuities offer enhanced death benefits to allow beneficiaries to offset taxes or spread. Qualified annuity distributions are fully taxable. You may also have to pay fees to.

Ad Get this must-read guide if you are considering investing in annuities. Others Taxation of inherited annuities is different for spouses and non. If a non-qualified annuity is annuitized then a portion of the.

Learn why annuities may not be a prudent investment for 500000 retirement portfolios. Lets look more closely at the key tax rules on inheriting a non-qualified annuity. Ad Inheritance and Estate Planning Guidance With Simple Pricing.

So the person who inherited the annuity can receive a guaranteed lifetime that will also spread out the tax liability. Are Inherited Annuities Tax Free. Give And Gain With CMC.

Inherited Annuity Tax Implications. All 20000 withdrawn from the annuity will appear on your tax return as ordinary income. When you inherit an annuity the tax rules are similar to everything described above.

Earn Lifetime Income Tax Savings. To avoid taxes on inheritance for your beneficiaries utilize a deferred annuity or a life insurance policy. Instead you pay taxes later when you receive the funds.

The money from an inherited annuity can be paid out as a single lump sum which becomes taxable in the year it is received. An annuity is a financial product that can be passed down from one generation to another. You live longer than 10 years.

Once the money is inside of an annuity it grows tax-free or rather tax-deferred so the policyholder does not have to pay taxes on the growing account. At that point you have a 180000 account of which 100000 is cost-basis that will never be taxed and. The taxation of any annuity which has been inherited by a beneficiary will be dictated by the age of the original owner upon their death.

C Elect within 60 days to. If you inherit an annuity you may have to pay taxes on your money.

Qualified Vs Non Qualified Annuities Taxation And Distribution

How Are Inherited Annuities Taxed Annuity Com

How To Calculate Taxable Income On An Annuity Youtube

What Is The Best Thing To Do With An Inherited Annuity Due

![]()

Inherited Annuity Tax Guide For Beneficiaries

Annuity Taxation How Are Annuities Taxed

Inherited Annuity What Are My Choices

Annuity Beneficiaries Inheriting An Annuity At Death 2022

Inheriting An Annuity Stretch Its Tax Benefits Kiplinger

How To Avoid Paying Taxes On An Inherited Annuity Smartasset

How Are Inherited Annuities Taxed

How Are Annuities Taxed Safemoney Com

Pass Money To Heirs Tax Free How To Avoid Taxes On Inheritance

Are Inherited Annuities Exempt From Federal State Taxes

:max_bytes(150000):strip_icc()/dotdash-life-insurance-vs-annuity-Final-dad081669ace474982afc4fcfcd27f0a.jpg)

Life Insurance Vs Annuity What S The Difference

Annuity Beneficiaries Inheriting An Annuity After Death